Upstart is Bankrate’s 2024 awards winner for very best bad credit score private loan lender, offering loans for borrowers with credit rating scores as low as three hundred or no credit rating background.

Curiosity rate: The reduced the interest rate, the decrease the total expense of the loan. Several lenders will pre-qualify you to get a loan with out conducting a tough credit rating Look at. Pre-qualification isn't a promise that you will obtain the loan.

You prefer not to tie up your own home’s equity: If you intend to offer your own home or favor not to take the risk you might eliminate your home because of a loan default, a private loan doesn’t include a lien to your house.

Kiah Treece is a small business enterprise proprietor and private finance professional with working experience in loans, company and private finance, insurance and housing. Her concentration is on demystifying personal debt to assist persons and business people consider Charge of their fina...

As helpful as a personal loan might be, it’s not the ideal monetary item For each and every human being. Below’s what you need to know about the benefits and disadvantages of loans:

If you need to borrow $35,000 and you simply're wanting to know no matter whether a personal loan could perform for your requirements, take into account the curiosity level and every month payment volume. Some lenders provide loan conditions assuming that eighty four months or seven many years, which often can decreased your more info month to month payment.

Enable’s dive into what helps make a development loan the very best for your requirements and which banking companies stand out in supplying these products and services.

Kiah Treece is a little small business owner and personal finance skilled with encounter in loans, enterprise and private finance, coverage and real estate. Her concentrate is on demystifying personal debt to help you persons and entrepreneurs consider control of their fina...

To secure a $35,000 individual loan, you’ll need to have to pick a lender that offers large loan amounts and Test you make more than enough to pay for the payment. Dependant upon your credit rating rating, a $35k loan could include an APR as significant as 35.ninety nine p.c, earning the payment too expensive Even though you make an excellent cash flow.

HELOC A HELOC is usually a variable-level line of credit rating that permits you to borrow funds for any set interval and repay them afterwards.

Vikki Velasquez is a researcher and author who may have managed, coordinated, and directed various community and nonprofit companies. She has carried out in-depth investigation on social and financial challenges and it has also revised and edited instructional elements for the Greater Richmond location.

As a initial step, you might want to compute the equivalent fee, which is adjusted for compounding frequency. Considering that, in the current scenario, the payment frequency as well as compounding frequency coincide, the equivalent charge equals the offered desire rate. If you'd like to Look at the formula for this calculation, pay a visit to our equivalent fee calculator.

50% autopay low cost Cons Checking premiums would require a tough credit pull (and knock several details off your rating) Can’t use cash for training or small business applications Should have very good or great credit history to qualify What to grasp

LendingClub offers payment day adaptability along with a immediate payment option to creditors you need to pay off with debt consolidation. However, the lender’s sixty-month highest term may well make your payment unaffordable, especially if your level is near its 35.99 % optimum.

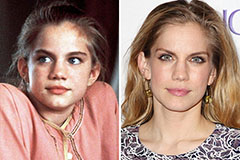

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Batista Then & Now!

Batista Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!